Can’t-Miss Takeaways Of Tips About How To Sell Treasury Bonds

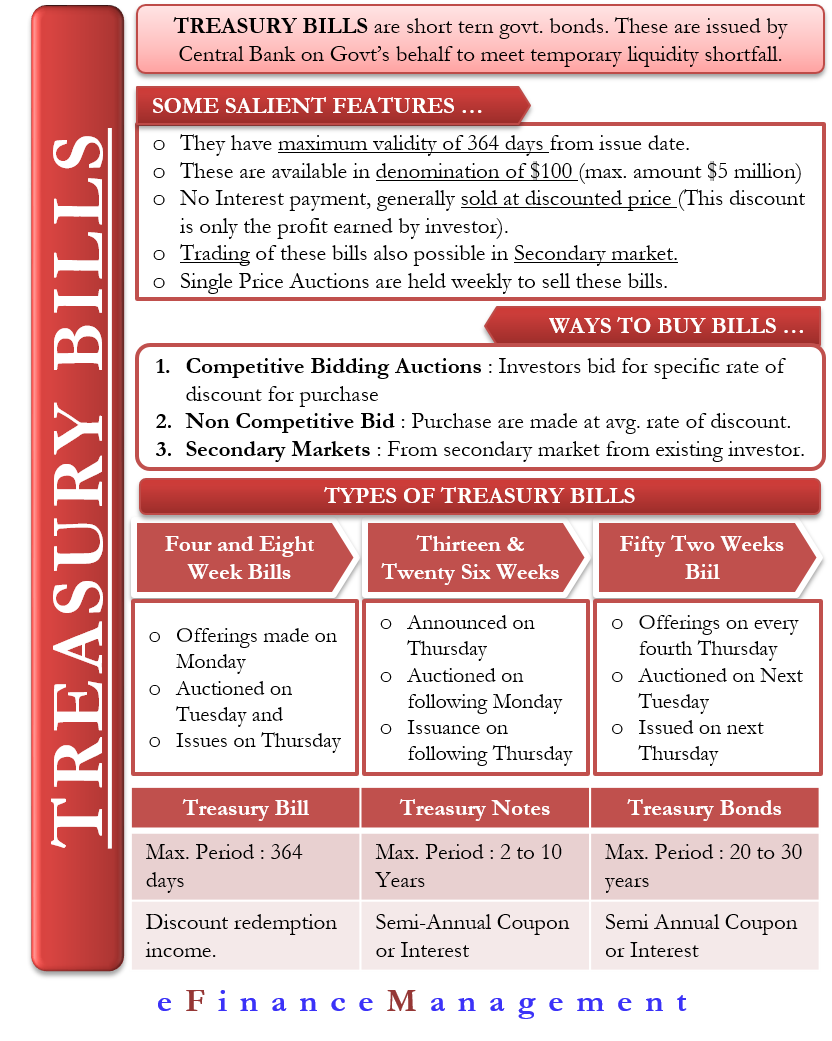

Complete fs form 5511 and mail it as directed on the form go to manage direct choose transfer securities identify the bill or bills you want to transfer choose external.

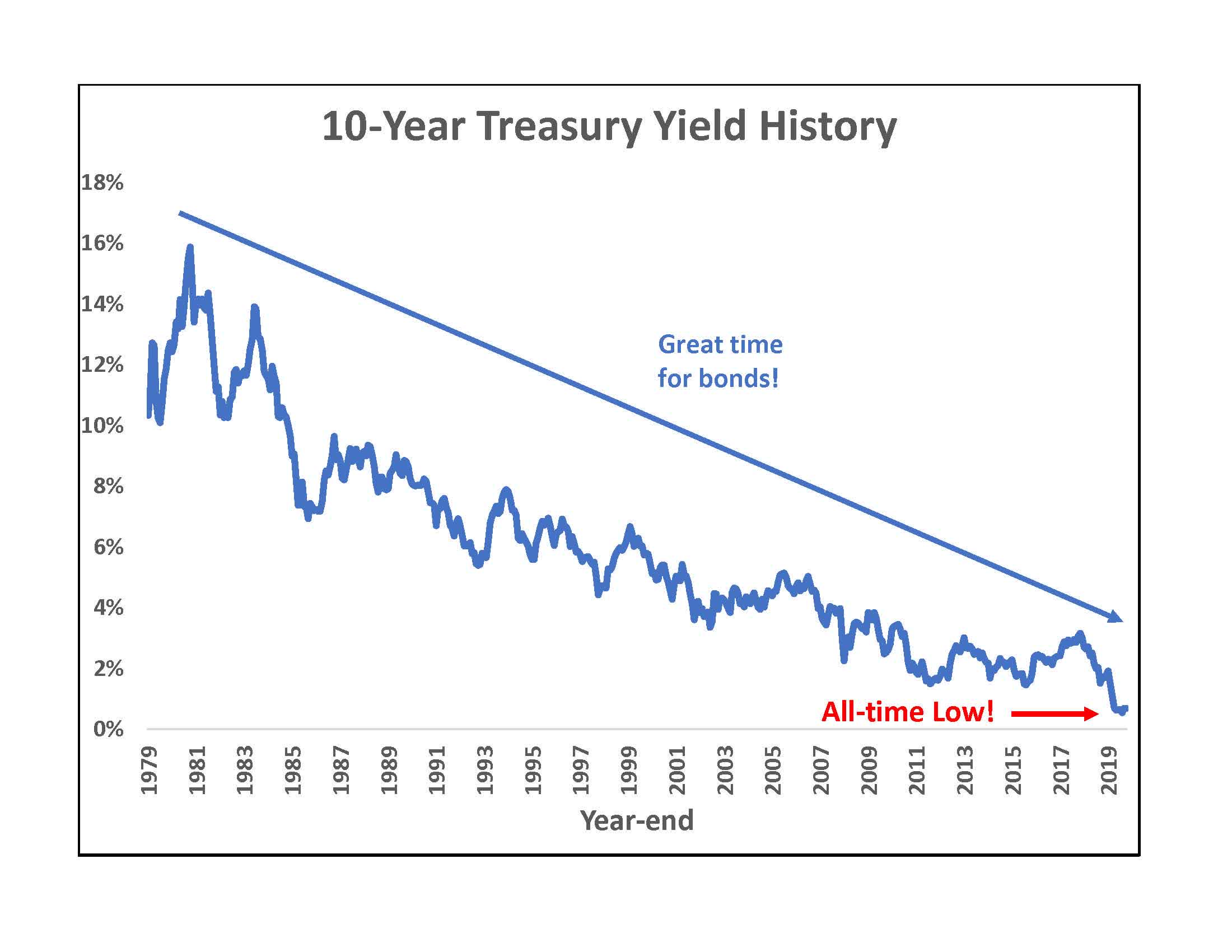

How to sell treasury bonds. Maturity periods range from 20 to 30. Instead, they are sold at a discount to. “the bank of england, in line with its financial stability objective, carefully monitors financial markets and any potential risk to the flow of.

The new variable rate everyone is talking about — 7.12% for six months — applies to all i bonds ever issued, not just the newly minted november 2021 version. If the bond is worth more, the teller will have you sign the bonds, which must be sent off for redemption. The way you buy and sell bonds often depends on the type bond you select.

Mail the signed bonds to the treasury retail securities site for your region. Treasury and savings bonds may be bought and sold through an account at a brokerage firm, or by dealing directly. To sell treasuries held in treasurydirect, you should transfer them to an account with a bank, broker, or dealer, then ask them to sell them for you.

You will need to validate your identity. Be sure to include the serial number of the bond. You can sell back your i bonds through the federal government’s treasurydirect site or by snail mail via its treasury retail securities services.

You don't need to sign the bonds. Be sure to include the serial number of the bond. How much the principal value of the treasury bond increases will depend on inflation.

You also need to have access to a. But investors who sell a bond before it matures may get a far different. They are a loan to the u.s.

/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

:max_bytes(150000):strip_icc():gifv()/treasurynotes-bills-and-bonds-3305609-finalv42-fc941b4ff55d4247951067ef742a406b.png)

:max_bytes(150000):strip_icc()/WherecanIbuygovernmentbonds1_2-8e2ac360d217459eb54ebea0070eb5b5.png)

/WherecanIbuygovernmentbonds1_2-8e2ac360d217459eb54ebea0070eb5b5.png)