Formidable Tips About How To Reduce Your Apr

The higher your credit score and the cleaner your history, the more likely you’ll be able to negotiate a lower apr.

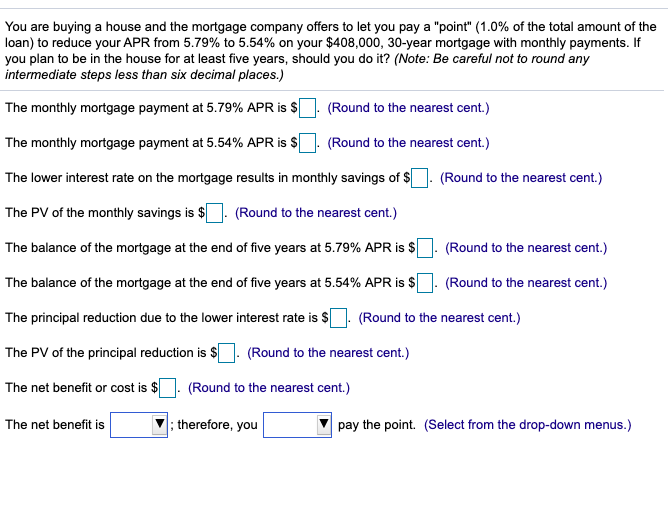

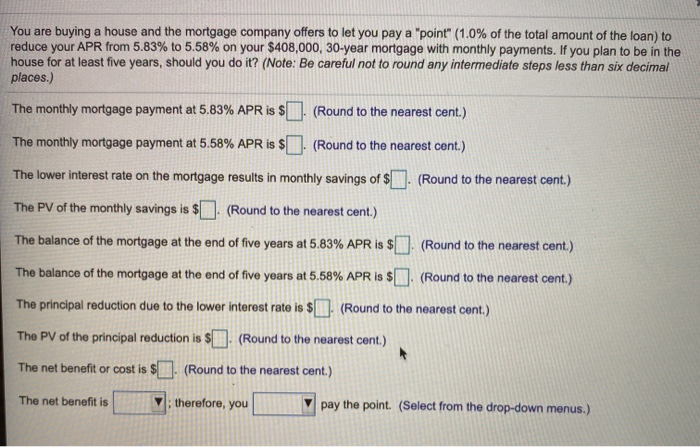

How to reduce your apr. You have a credit card that has a $10,000 balance. It can help your case, in some instances. This will help you to pay off the current loan with the high interest rate, and then only pay on the.

Your credit card company most. Listen through the service menu, and the automated voice will ask what you. The squeaky wheel really does get the grease.

Because your credit score can be a factor in. Maintain a good credit score keep track of your credit score regularly and. Your credit card company won't lower your apr just because you've been taking care of your credit;

Try to keep your credit utilization rate — the percentage of your credit limit that you’re using — at 30% or less. You can lower your apr by securing a loan through your home equity line of credit. Take your apr and divide it by 12 (12 months in a year) and then multiply that by your monthly balance.

Find competing credit card offers credit card issuers and. Gather lower rate offers a key part of the negotiation process. In fact, there are certain ways to reduce apr in order to be able to get a lower interest rate and thus lower monthly payments on a loan.

Your best path forward will depend on your monthly. In turn, this can make it easier and faster to pay off. How can i lower my credit card apr?

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)